Celcom claims to be the largest private mobile network operator with over 14 million users on its 2G and 4G networks. At the moment, the operator says it has 96.21% 4G population coverage nationwide and has invested over RM1 billion into its 4G network in the past 18 months. As shared during its recent H1 2022 report, the average data consumption by Celcom customers is 24.2GB per month.

Celcom has started its friendly 5G user trials with selected customers. Eligible Celcom customers will be able to access 5G for free until further notice and will also get to access 5G roaming in 15 countries.

Plans for a merger of Celcom and Digi were first confirmed back in June 2021, with a formal application for the merger subsequently lodged with the Malaysian Communications and Multimedia Commission (MCMC) in November 2021. With the local telecoms regulator having confirmed its approval for the deal in June 2022, it was noted that this was subject to a number of undertakings that the two operators had submitted after the MCMC in April 2022 raised potential issues that could arise from the tie-up. Upon completion, Axiata and Telenor will each hold equal ownership of 33.1% in the new merged company, which will be named Celcom Digi Berhad and will continue to be listed on Bursa Malaysia.

Maxis is the first operator in Malaysia to provide its customers with 5G international roaming services in Singapore, Thailand and Indonesia. The 5G roaming service will be activated automatically on any 5G-enabled device.

The DNB was set up last year by the Malaysian government to speed up the deployment of 5G services across the country.

The new company has sought to partner with all six of the main operators in the country -- Maxis, U Mobile, Telekom Malaysia, YTL Communications, Celcom Axiata, and DiGi, and all take equity stakes in a state-controlled 5G single wholesale network run by the DNB.

All six of the operators agreed to the proposals last month, after being offered a combined 70 percent stake in DNB, dependent on all six operators agreeing to the terms. However Maxis and U Mobile pulled out at the last minute, as neither saw benefits to the agreement, although both 'want to remain in talks for access to DNB's 5G network'.

Operators have been sceptical of the proposals put forward by the DNB, with many initially reluctant to agree to the plans, but the DNB has insisted its 5G strategy will keep costs lower and speed up the deployment of 5G services in the country, which has faced regular delays.

The DNB says the rollout will cost RM16.5 billion ($3.7bn) for the next decade, with Ericsson selected as the network equipment provider.

In their quest to become Malaysia’s preferred digital operator, U Mobile have introduced many first-of-its-kind digital services to the market such as telco assurance products. U Mobile also has a comprehensive fintech ecosystem offering that consists of GoPayz, a universal e-wallet which offers consumers digital financial and lifestyle services, and GoBiz, a digital payment acceptance solution designed for businesses both big and small.

Being the youngest telco also means U Mobile has the most modern network infrastructure that enables us to scale up based on demand in the most efficient way. Our award-winning robust network is also ready for 5G and beyond and they are committed to continue investing in our network so that our customers will always enjoy a superior network experience.

U Mobile is the first operator to offer a massive 1,000GB (1TB) of high-speed 4G/5G-ready data with its new U Postpaid 98. Customers are able to experience true worry-free connectivity at just RM98. U Postpaid 98 customers can also share their huge 1,000GB of high-speed data and unlimited calls with up to 6 family members for only RM38 per line, making it the most unbeatable family option in the market today. Customers shopping for a new 5G device also have the option of getting the device on instalment with 0% monthly interest via U Mobile’s U PayLater, or with U SaveMore, which offers more savings on device.

In 2016, Telekom Malaysia and P1 now called Webe officially launched after its predecessor, TMgo, based on 4G/LTE-only running at 850 MHz (band 5) as well as TD-LTE bands 38 and 40 that are able to deliver download speeds up to 20 Mbps. This was closed later and relaunched as 'unifi Mobile' with 3G roaming included.

Yes by YTL Corporation started in 2010 and now covers more than 85% of population by 4G/LTE only on the West Malaysian Peninsula, but are rolling out networks in major cities in Sabah and Sarawak. Yes currently running on FD-LTE and TD-LTE on 800 MHz (Band 20), 2300 MHz (Band 38) and 2600 MHz (Band 40).

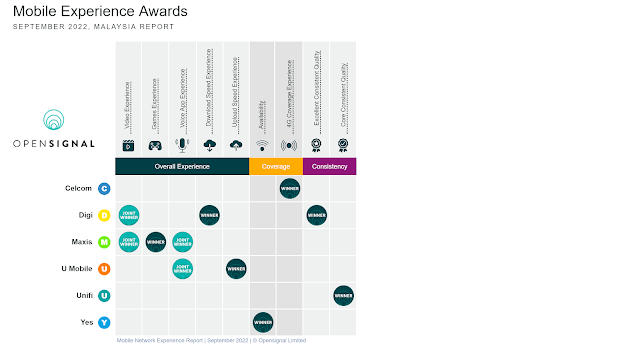

When it comes to coverage, Yes is awarded the best for availability with users connected to 4G and above 98.8% of the time. At the moment, Yes is also the first and only telco to offer 5G coverage via Digital Nasional Berhad. This is followed closely behind by U Mobile at 98%, Maxis at 96.7%, Digi at 96.1%, Celcom at 96% and Unifi Mobile at 95%. Opensignal has stated that the availability metric is not a measure of a network’s geographical extent and it shouldn’t be used as an indicator if you are likely to get a signal if you visit a remote rural or uninhabited region.

Related Posts:

- Telecoms Infrastructure Blog: Malaysia Looks at Small Cells for 5G

- Operator Watch Blog: Malaysia Decides on Innovative Approach for 5G Spectrum

- Operator Watch Blog - Malaysia: 5G Trials and Updates

- Operator Watch Blog - Malaysia: Challenges of 4G

No comments:

Post a Comment