Burkina Faso’s telecom sector in recent years has made some gains in providing the necessary infrastructure and bandwidth to support telecom services. An IXP completed in September 2020 increased international bandwidth capacity by a third, while in mid-2021 the government was able to start the second phase of a national fibre backbone project. This will link the capital city to an addition 145 municipalities, and provide additional connectivity to terrestrial cables in neighbouring countries.

This new infrastructure is also making it possible for the government to trial telemedicine, and so address the very poor availability of medical services in almost all parts of the country. However, the government, newly elected in November 2020, is under popular pressure to address security issues. Civil disturbances erupted in November 2021 after the government proved incapable of preventing killings by militants. The activities of the militants in side areas of the country jeopardise overall security, and render it difficult for the telcos to safeguard their networks and equipment.

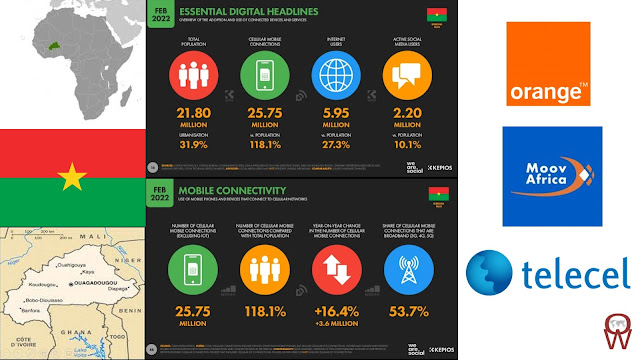

There are three mobile operators in Burkina Faso: Telmob, the mobile arm of the fixed line incumbent Onatel (National Office of Telecommunications), which is partially owned by Morocco Telecom and has now been rebranded as Moov, Orange Burkina Faso SA (owned by Orange Middle East & Africa (OMEA) and Telecel FASO SA (owned by a local group, Planor Afrique). The market has been competitive since 2000. Mobile access is relatively high, with 86 per cent of households owning a portable telephone, of which 97 per cent are in urban areas and 82 per cent in rural areas.116 Licenses for 3G were issued in 2012 and mobile-broadband has since been growing rapidly. Operators have also launched mobile money services since 2013.

Orange, formerly Airtel Burkina, is broadcasting 2G on 900 MHz and 3G on 2100 MHz bands with good coverage in the country (coverage map). The company has been acquired by France Télécom in 2016 from Bharti Airtel, and rebranded it to Orange in 2017. It has become the market leader in 2018 with 49% share. They started with 4G/LTE in 2019 in the capital and 5 other locations on 1800 MHz (B3).

Onatel is the partially state-owned provider, but for 51% owned by Maroc Telecom. It has now been rebranded as Moov Africa. It's mobile branch was called Telemob before. For "fixed" lines they broadcast on 2000 MHz CDMA for which no prepaid packages are available and hence not mentioned further.

The GSM signals are broadcast in the 900 MHz band for 2G and 2100 MHz for 3G. 4G/LTE started in 2019 in 35 locations from launch, including the capital of Ouagadougou: Coverage map . Onatel lost the market lead in 2018 to Orange with 46% customer share.

Telecel Faso is member of the Telecel group owned by Planor Afrique active in many West-African countries. They broadcast on 900 MHz band with 2G/GPRS, and finally caught up in 2017 by being available on 2100 MHz for 3G in Ouagadougou, Bobo-Dioulasso, Koudougou and Hounde as well. They are the smallest provider in the country with only 19% share.

In 2020 they announced the launch of 4G+ (LTE-A) mobile services which deliver download speeds of 100Mbps and upload speeds of 20Mbps, as the operator moved to match rival offerings in Burkina Faso.

Burkino Faso’s government has detailed its National Strategy for the Development of the Digital Economy, which seeks to boost connectivity in urban areas.

Local news outlet Le Faso reports that the cities of Ouagadougou, Bobo-Dioulasso, and Koudougou will be prioritized for high-speed broadband connectivity during the plan’s first phase, with the remaining regional capitals the focus of phase two.

Kisito Traore, Secretary-General of the Ministry of Digital Economy and Posts (MDENP), stated that the strategy was aimed at correcting “significant territorial disparities” in Burkina Faso’s digital infrastructure, noting that “the majority of the population has limited access to broadband and access to very high speed internet is marginal.”

TeleGeography reports that under the strategy, the Ministry aims to deliver fibre optic connectivity to all administrative buildings, companies and universities by 2030.

Related Posts:

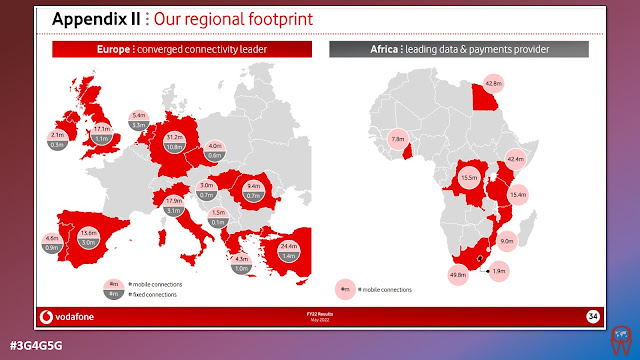

- Operator Watch Blog: Maroc Telecom Rebrands as Moov Africa

- Operator Watch Blog: Maroc Telecom's African Presence