Iraq continues to face a number of political and economic challenges, though increasing civil stability has made it easier for mobile and fixed-line operators to rebuild telecom services and infrastructure damaged during the last few years. The government was minded to extend the licenses held by the MNOs for an additional three years to compensate for the chaos and destruction caused between 2014 and 2017 when Islamic State held sway in many areas of the country. However, this plan was scuppered by opposition among some politicians, who asserted that the market needed more competition rather than extensions of existing licenses.

The three major MNOs are Zain Iraq, Asiacell, and Korek Telecom, which together control over 90% of the mobile market. The operators have struggled to develop LTE services, partly because of issues related to damaged infrastructure but also partly due to wrangles with the government and regulator concerning the conditions of their licences. With the availability of LTE services being very low, there is little change for 5G to be available in the short term. In the meantime, most services are still based on GSM and 3G, except in the Kurdish region where LTE is more widely available.

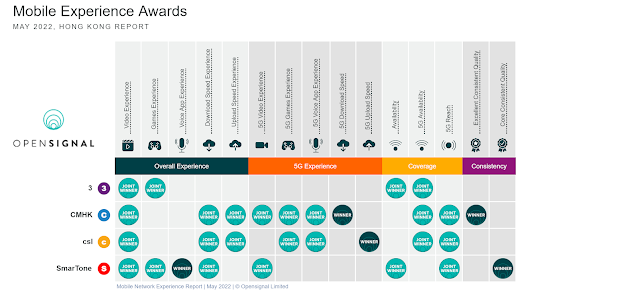

In the most recent Open Signal report on mobile network experience of Iraqi users, Asiacell wins the lion’s share of awards, winning both speed awards (Download Speed Experience, Upload Speed Experience), all three of the experiential awards — but sharing Games Experience with Zain — and all of the Coverage awards (Availability, 4G Availability and 4G Coverage Experience. On the other hand, Zain picked up both Consistency awards — Excellent Consistent Quality and Core Consistent Quality. Zain also places second in almost all of the award categories that Asiacell wins outright, with the only exception being Availability where it had to settle for third place behind Korek. Korek does not claim any awards this time — either solely or jointly — but placed second in Availability and both Consistency categories.

Asiacell describe themselves as leading the change with their nationwide fast, reliable, and secure 4G+ data speed coupled with award-winning coverage serving more than 16 million customers at 21000 points of sales and outlets throughout the country thanks to their extended advanced network of 7200 LTE sites.

Asiacell in August 2021 signed a five-year deal with Nokia to upgrade its microwave network to address growing capacity demands and provide reliable, low-latency connectivity. Under the agreement, the Finnish vendor will replace or modernise legacy equipment, deploying around 3,000 network links across the country. Nokia will supply products from its ‘Wavence’ microwave packet radio portfolio, which it claims will improve cost efficiency and performance, adding that its ultra-broadband transceivers will enable Asiacell to provide ‘fibre-like’ connectivity in areas where fibre cannot be deployed.

Commenting on the deal, Asiacel CEO Amer Sunna was quoted as saying: ‘We are pleased to extend our partnership with Nokia by trusting them with yet another project. Improving network performance and enhancing the end-user experience has always been our top priority and having Nokia as a strategic partner is helping us achieve this. By leveraging Nokia’s global scale, we look forward to building a future-proof network that will help us meet the growing mobile traffic demand in Iraq.’

Korek Telecom proclaims themselves the fastest growing mobile operator in Iraq, offering the largest and most reliable mobile network. Their network covers the entire country and its cutting edge technology ensures they match the best network quality with best in class services. Serving the 18 provinces of Iraq, Korek offers a comprehensive range of wireless communications services bringing the freedom of mobility to consumers, businesses and government users.

Zain Iraq works to provide the best and most modern telecommunications services to the Iraqi customers and to provide exclusive and innovative offers to its subscribers, specifically after launch 4.5G+ services as the first telecom company in all parts of Iraq through a cooperation with its global technology partners certified for the latest technologies and communication solutions

Zain Iraq’s vision for the year 2022 is centered on creating partnerships with the youth, providing them with products and services that can help them communicate with the world.

Zain Iraq’s 2021 revenue reached USD 769 million, and EBITDA amounted to USD 312 million, reflecting an EBITDA margin of 41%. Net profit reached USD 42 million for the period. The operator’s customer base increased by 2% to reach 16.4 million customers. It should be noted that the Iraqi dinar devaluation also impacted Zain Iraq’s revenue by USD 172 million for the year.

Zain has launched a virtual 5G-ready network in Iraq, under the name Oodi, with US-based digital commerce company Matrixx Software. Zain, based in Kuwait, says that Oodi uses out-of-the-box software capabilities to provide Iraqi customers with complete flexibility, transparency and ease-of-use.

Ali Al-Zahid, CEO of Zain Iraq, said: “Our number one priority is to provide our customers with the best and most advanced services.” According to Google Translate, “oodi” means “friendly”.

Al-Zahid added: “Delivering upon those promises requires forging partnerships with forward-thinking companies that can make the future of mobile services and customer experience a reality.”

Zain said customers can create their own plan, and can see account balances, services and spending using the software.

Related Posts:

- Operator Watch Blog - Iraq: Efforts at Recovery

.png)