Mali’s topography includes large tracts of sparsely populated desert, with many settlements being hard to reach and thus rendering it difficult and expensive to provide effective fixed or mobile networks.

Security issues have also been a concern, leading to delays in building the national backbone network. Following a coup in 2012 large areas in the north of the country were taken over by Islamic militants. The coup of September 2020 unsettled politics, and was soon followed by a second coup. The coup leaders put off holding the promised elections, and this in turn contributed to the February 2022 decision by France and other European governments to end their military support against the militants. Many areas of the country have remained generally ungovernable.

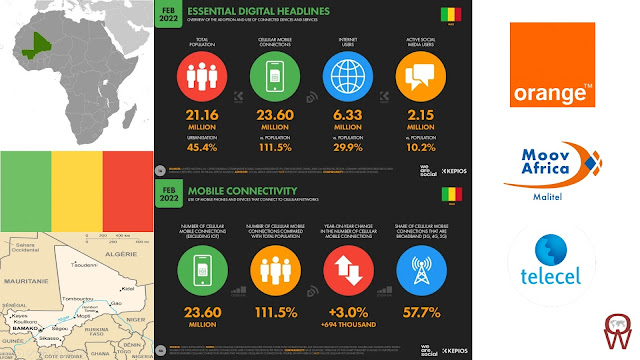

Compounding these difficulties is the fact that underinvestment in fixed-line networks has meant that telecom infrastructure is barely adequate to serve consumer needs in most towns and is largely absent in most areas of the country. In addition, a combination of poverty, high illiteracy, and low PC use has led to a very low take-up of fixed-line internet services. In common with many other countries in the region, Mali has taken to mobile networks for voice and data services. Mobile networks account for about 98% of all telecom connections. Despite these challenges, there has been progress in fixed-line connectivity, particularly during 2020 and 2021.

Orange Mali entered the market as the second mobile and fixed-line operator in 2003, and soon became the dominant provider. The duopoly with the national telco, Sotelma, continued until late 2017 when Alpha Telecom (after much delay) launched mobile services. A fourth mobile licence was secured by Mobilis, owned by Algérie Télécom, at the end of 2019.

Mali’s landlocked location makes it dependent on neighbouring countries for international bandwidth, which has kept internet prices high. Improvements in this sector can be expected from the recent arrival of several new international submarine cables in the region, while Orange Group has also been engaged in building a terrestrial network linking the capital cities of eight countries in the region, including Bamako.

Orange Mali owned by French Telecom is the current market leader. The company was extremely successful when it entered the market as the 2nd mobile and fixed-line operator in 2003. They quickly amassed more than 80% market share, offering converged fixed, mobile and broadband internet services.

At the end of 2016, Orange Mali’s network covered about 95% of the population and 46% of the country and had a base of 11 million active mobile subscribers, of which more than 99% were prepaid customers. Their uses mainly cover voice, mobile internet and mobile payment services. Only around 20% of the population have 3G coverage with speeds up to 42 Mbps like in Bamako and other regional capitals. In 2017 Orange Mali renewed its license and received permission to launch 4G/LTE services. It already trials 4G/LTE in Bamako, that is to be expected to be commercially launched by 2018.

Like in most parts of Africa mobile networks double as a payment system. Started in 2010, Orange Money service had 3.5 million customers at the end of 2016.

Orange Mali has claimed the country’s first 5G network tests, presenting its progress at a pilot project launch event on 7 July 2021 attended by government officials including Harouna Mamadou Toureh, the Minister of Communication, Digital Economy & Modernisation of the Administration. Agence Ecofin reports that Orange has begun testing 5G technology in Mali’s capital city Bamako and other regions.

Some months back, Intelsat announced that it has been selected by Orange Mali to bring 3G and 4G connectivity to hard-to-reach areas in the country. The press release highlighted that this agreement ‘marked a first in Francophone West Africa – the successful deployment of 4G networks over satellite, judged to be the optimal solution given the size of the country and the logistics involved’.

Malitel (recently rebranded to Moov Malitel) operated by SOTELMA is the old state telecom provider and first mobile network in the country since 1989. It was privatized in 2009 and now owned: 50% by Maroc Telecom, 20% by local investors, 20% by the Mali government and 10% by staff.

In user numbers and coverage Malitel is in the 2nd position in Mali right now caring for about 41% of the mobile market as well as for a rather limited landline system.

Their 3G coverage is restricted to the towns of Bamako and Kati, Kayes, Koulikoro, Sikasso, Segou, Mopti and Kenieba, the mines of Loulou, Tabakoto, Gounkoto, Sadiola, Siama and Morila as well as Diboli on the border to Senegal. Outside these areas there is only coverage with GPRS at 54 Kbit/s. 4G/LTE has been started at the end of 2018.

Nice post thank you Jeron

ReplyDeleteMost of the information in this article was gleaned from a report published by BuddeComm.

DeleteIt's from BuddeComm report on Developing Telecoms that has been linked in the article.

Delete